By David Resetar | Head of Innovations at Cycle Connect

Innovating Around Financial Inclusion for Smallholder Farmers

At Cycle Connect, we are innovating around financial inclusion to create access and opportunity for the world’s number one population, smallholder farmers.

The Cycle Connect Journey

Three years ago Cycle Connect had just one product: bicycle loans. We felt that bicycles were the perfect asset for smallholder farmers living in the last mile. Bicycles are affordable, versatile, and in high demand.

We also understood that farmers wanted access to payment plans. The vast majority of our clients cannot access formal credit services. For many, Cycle Connect has been the only lender to actively reach out. Now we offer more products and several types of financing to match our specific smallholder client needs.

As we grew, so did the kinds of clients we worked with. Cycle Connect serves savings group members who have few sources of income, individuals with multiple sources of income, as well as returning borrowers. These segments have a variety of needs and problems with many possible solutions.

After checking in with customers, industry experts, and field staff, we took the time to prototype and test some of their ideas. Last year we established an Innovations Department to house and regularize this process of listening to customers and testing different ways to meet their needs.

The Role of Innovations in Financial Inclusion

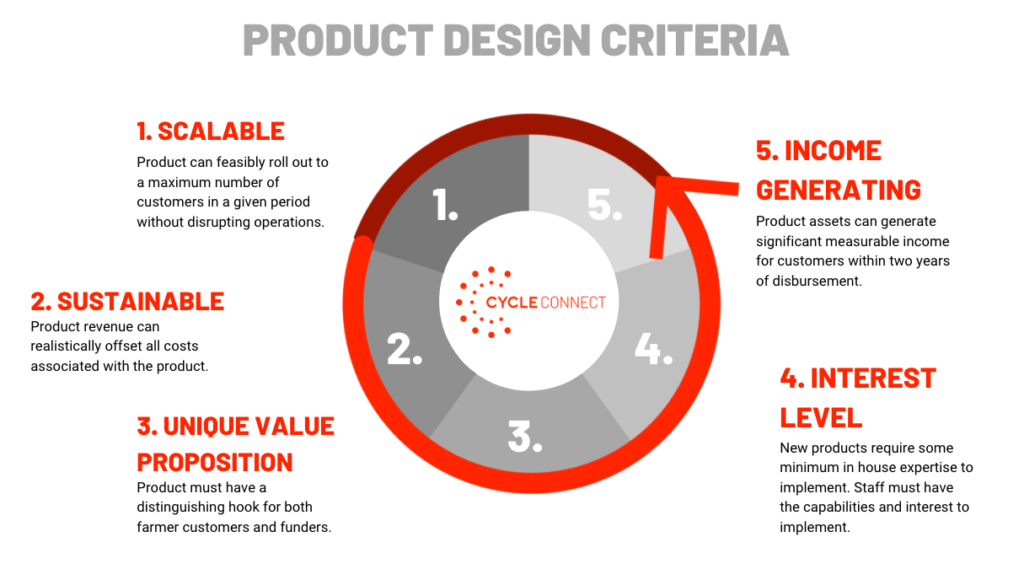

The aim of innovations as we see it is to create products that are accessible and profitable for the most people possible. We look for ways to improve our current offerings or test new ones to match our customers’ specific needs.

Here are some of the areas we are exploring right now as we seek to innovate around financial inclusion for smallholder farmers:

- Mechanization: We are on the lookout for products and services that help farm production while lowering their costs. We are looking at machines that can improve production, processing, and transport many times over manual labor.

- Practical training: We are improving the way we train our staff and our clients to get the highest return of investment on their productive assets. Best-Practices training might be the most cost-effective way to improve livelihoods.

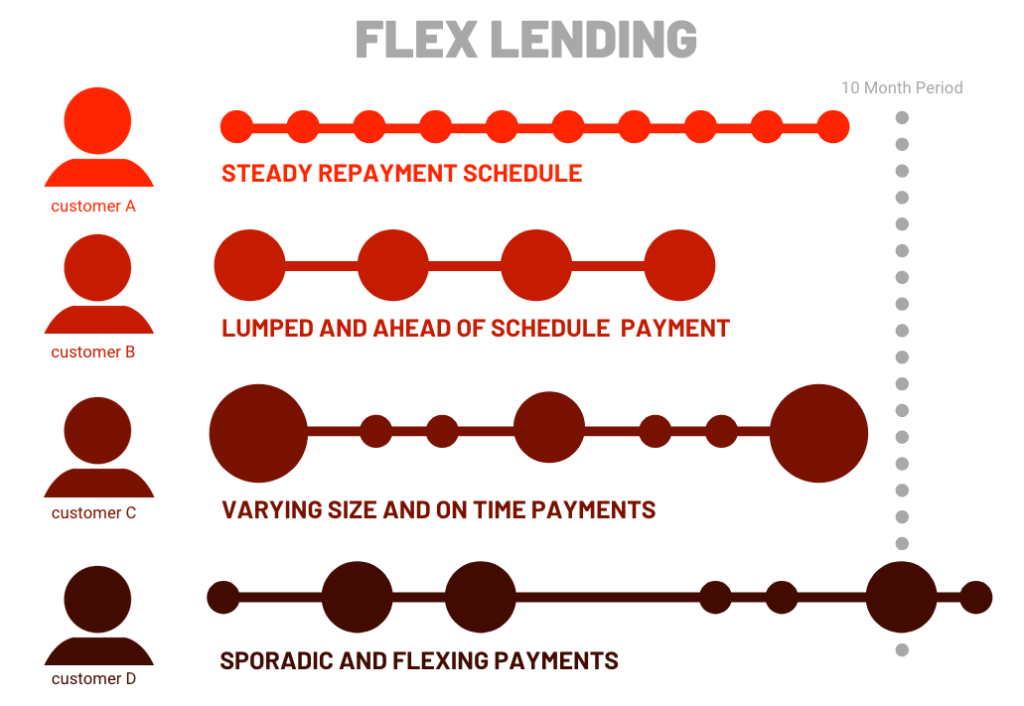

- Flex lending and nudges: Smallholder farmer income is complex. We are trying out different financing schemes that can match when farmers have money. We have started testing flex repayment scheduling, informative messaging, and incentives for good performance.

Mechanizing Agriculture

We believe in the power of productive assets to substantially enhance smallholder farmer income. We combine access to improved assets and coaching on best practices to maximize our impact. The assets we choose increase

Tractors not only boost efficiency and crop yields but can also multiply the amount of land farmers cultivate. We are testing out loans that bundle land clearing and plowing services with extra inputs to allow farmers to increase the amount of land on which they can plant. That means a farmer who owned an acre last year can plant two acres this year without having to purchase more land and at a fraction of the cost.

Training Our Trainers

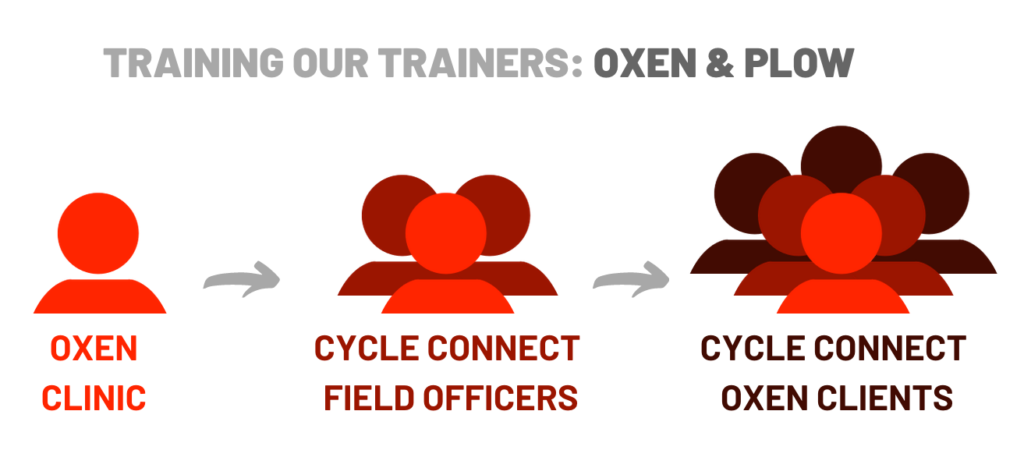

Cycle Connect finances hundreds of draught oxen loans a year. Oxen allow farmers to increase yields and eventually make money hiring out their animals to other farmers. Oxen have superior ground traction and can work in places tractors cannot. A pair of oxen can pay for their purchase price after renting them out for only 15 acres. But it takes a lot of skill to guide an oxen to plow efficiently.

We recently teamed up with Oxen Clinic of Uganda to train our field officers on the practicals of oxen plowing. Oxen can sound frustrating to the uninitiated, but with the right coach, most people are able to use draught animals well and generate extra money during lean seasons.

Flex Lending and Nudges

Even with the right product and training, most of our farmers could not afford a productive asset without loan financing. Loans do not adequately account for the seasonal nature of farmer income. We know that farmers make the bulk of their incomes in the weeks and months after they harvest. But even detailed seasonal crop calendars cannot accurately predict when prices will peak or when farmers ought to sell.

Due to the sometimes sporadic nature of farmer cash flows, we are experimenting with flex lending. Flex lending sets minimum repayment targets while allowing borrowers to make bulk repayments at anytime. We send well-timed messages to let borrowers know how much they need to pay to stay on track and help them plan ahead. We “nudge” customers by delivering information at critical times and offering in-kind incentives for leaders who help their groups meet targets. Flex means a farmer is not forced to sell their goods too early just to make a loan payment.

Cycle Connect is committed to offering meaningful options to those living outside the range of traditional institutions. We do that first by checking in with them on a regular basis and seeking out proven ways to address their issues. We also take the time to train

By innovating financial inclusion for smallholder farmers through this framework, we believe Cycle Connect can bring one million rural people out of extreme poverty by 2030.

See our rolling 2019 Impact Report.

0 Comments