‘Last mile’ is a commonly used phrase in the business world but what exactly does it mean?

The term can be defined in a multitude of ways. Reaching the last mile for Amazon means getting a package from a transport hub to a customer’s doorstep. For Home Depot, the last mile means penetrating the urban market. And, for fellow social enterprise, Last Mile Health, it means bringing healthcare to the hardest to reach places.

So, what does Cycle Connect mean when we say ‘last mile’?

At Cycle Connect, we define last mile as those who are excluded based on status and/or distance. Our last mile customers are farmers that are excluded by traditional microfinance institutions based both on their status as a smallholder farmer and their physical distance from these institutions.

82% of Ugandans, which are primarily farmers, rely on informal networks for credit (finclusion.org). There is a massive market gap among institutions offering farmer-centric loans—ones that are built specifically for farmers on terms and conditions, affecting how people repay as well as the barriers to entry in receiving a loan.

Banks and MFIs built their services around urban customer segments—those who have regular income and can pay back on a weekly or monthly basis. To reach farmers, they are simply tweaking their offerings. When in reality such institutions need to build new products, with farmers in mind from the ground up.

Cycle Connect is challenging this by going to where our customers are, evaluating them differently, interacting with them differently, and collecting from them differently.

We have a deep understanding of the context in which we work, giving us the ability to offer financial products that meet the unique needs of our last mile customers. A large majority are deep rural, so our customer-first business model is fully focused on going to them – which means getting to know their community, hand-delivering the assets, and being present to train and troubleshoot. This understanding also allows us to devise inclusive loan terms for our last mile clients and to appraise them accurately by screening the client as a farmer and giving great weight to behavioral variables, such as community interactions.

For our team, going the last mile can mean traveling anywhere from 5 to 100 miles on a motorcycle to reach our clients to provide them with access to our transformative products.

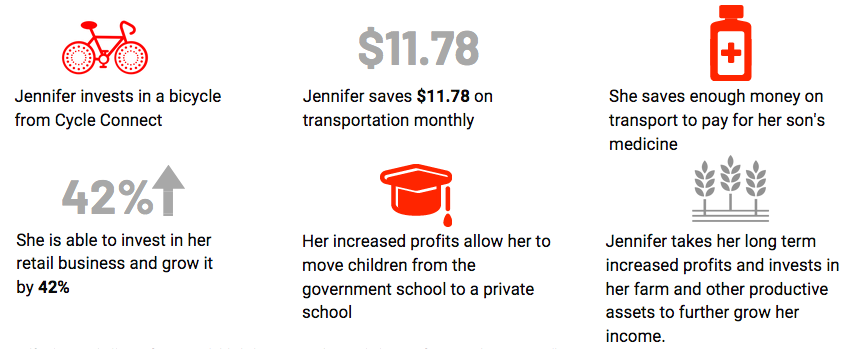

For Okello Jennifer, a smallholder farmer in northern Uganda, last mile access means an opportunity to increase income so that she can keep her family healthy. Jennifer lives in Awach Village which is fifteen miles outside of town. Her son suffers from recurrent pneumonia requiring many visits to the medical center. Both the transport to town and the medicine he needs is very expensive.

When Jennifer heard about Cycle Connect, she eagerly applied for a bicycle loan. She was approved and uses her new bicycle to provide for her family and to access the health center for her son’s treatment. The money alone that Jennifer saves on transport costs can pay for her son’s medicine. She can grow her income by more than $100 in her first year of owning a bicycle.

By going the distance to meet our clients where they are and through offering inclusive loan terms, our model is successfully lowering the adoption threshold to help more last mile farmers, like Okello Jennifer, to access life-changing assets to increase their income.

At Cycle Connect, we are committed to going the last mile to ensure smallholder farmers have the opportunity to invest in their future and achieve their dreams.

1 Comment

Peter Mugwanya

The work that cycle connect is doing is very transformative. In this day and age where the income disparity is increasing by the day. Without interventions by organisations like cycle connect a person like Jennifer will never have access to funds or assets that will move her from extreme poverty a vice that will affect many generations to come.

Thank you cycle connect. Many areas in Uganda need your service.